Reviewing your budget data will also help you anticipate your future spending needs, profits, and cash flow. If you find you’re getting a good return, that’s useful information when it comes to future decisions about allocating resources. Revisit it every month and see where you can adjust or experiment - maybe shift some funds to give your marketing budget a boost for a few months and see how it affects your sales pipeline. It should not be a static document that you check once a quarter or only at the start of the year. Now that you’ve set up your monthly budget, make sure to revisit it periodically.

Monthly expenses spreadsheet for small business how to#

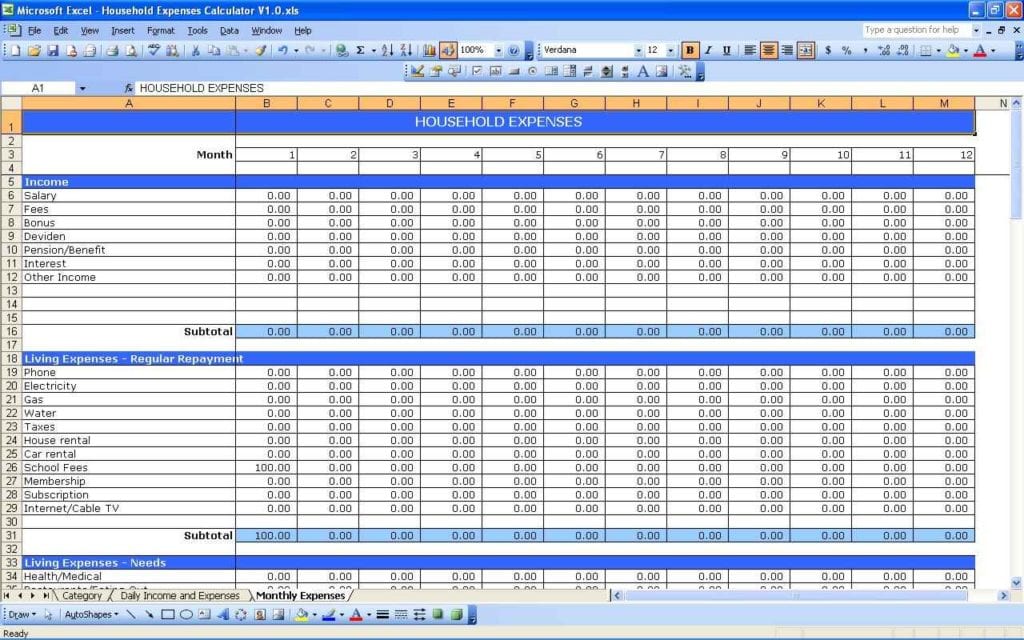

Once you have a profit estimate, you can determine how to invest in your business, whether that means upgrading equipment, moving to a larger office or better location, adding staff, or giving your employees raises. Profits: To determine profits, subtract your costs from your revenue.Semi-variable costs: These expenses are influenced by the volume of your business, including salaries, marketing and advertising, etc.Variable costs: These costs typically correlate with sales, such as the cost of raw materials to produce your product, inventory, shipping/freight, etc.These figures don’t typically change from month to month.

How does a monthly budget worksheet help you? But budgeting is absolutely essential to your success. Granted, you’d almost certainly rather spend time refining your product, talking with happy customers, or honing your investor pitch than hunch over spreadsheets, calculating the seemingly impossible amount of money it’s going to take to get your business off the ground. Business plans, leases, financing, legal documents - and monthly budget sheets. Starting a business can be an overwhelming process.

0 kommentar(er)

0 kommentar(er)